Are you in the Building & Construction, Cleaning, Security, Courier or IT industry?

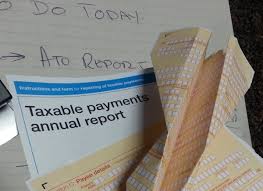

If you are, and you have paid contractors throughout the 2020 Financial Year, you are required to report the gross payment and GST paid by lodging a Taxable Payment Annual Report (TPAR). Contractors can include subcontractors, consultants and independent contractors. They can be operating as sole traders (individuals), companies, partnerships or trusts.

There are a number of ways of preparing and lodging your TPAR :

- your accounting software

- paper forms

- the ATO portal

These reports are mandatory, and fines can be applied if you fail to lodge by 28 August 2020.

We are ready to assist with the preparation and lodgement of your 2020 TPAR, please contact our office to discuss.

Author

Kate Lindquist