Do you want to pay off your home loan quicker?

What can you achieve through Debt Recycling?

Debt recycling is a strategy helping ordinary Australians pay off their home loans far sooner than ever thought possible. It enables you to:

- Repay your home loan quicker saving large amounts of interest.

- Build wealth in an investment portfolio outside of superannuation.

- Increase your tax deductions each year saving you tax.

Who can benefit?

Anyone who has a home loan with equity and wants to start investing for the future now, whilst also saving tax.

How does it work?

Debt Recycling involves 3 keys steps:

- Use your equity as security for a separate investment loan.

- Use the investment income and any tax savings you receive from your investments (as well as any surplus cash flow) to reduce your outstanding home loan balance

- Throughout the year, re-borrow from your investment loan the amount you have paid off your home loan to purchase additional investments.

Case Study

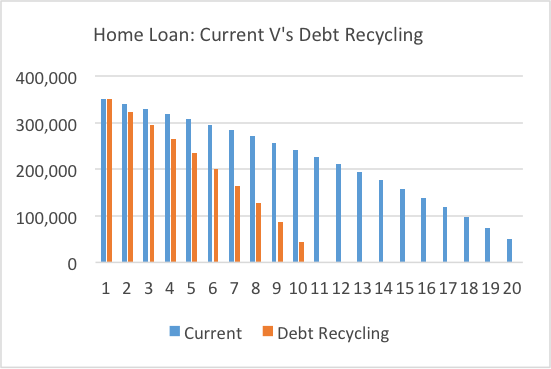

Jack and Kate have a home loan of $350,000 with a 5% interest rate paying $500 a week. Jack earns $80,000 a year and their home value is $500,000. They are wanting to build wealth for the future and pay off their home loan as soon as possible. They can budget $300 a week towards the Debt Recycling Strategy.

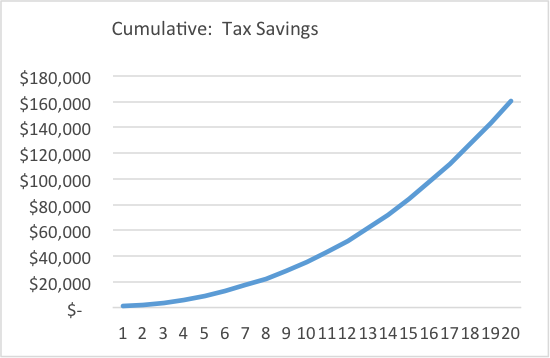

Using this Strategy Jack and Kate have paid off their home loan in 10 years, over 10 years before they would have done without using the Debt Recycling strategy. Jack and Kate will also have built a net investment portfolio which after 20 years will be worth nearly $750,000. If they wished they could pay the investment loan off earlier using the money previously used for the Home loan. Over the 20 years Jack created additional tax savings of over $160,000, an average of $8,000 a year.