If you’ve listened to the news lately, you’ll notice car sales have plummeted since the beginning of Covid-19. While the new Instant Asset Write-off legislation introduced on 12 March 2020 relates to more than cars, this is the question we’re most asked.

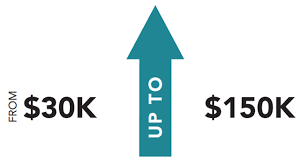

The government has legislated an increase to the previous limit of $30,000 for the instant asset write-off to $150,000. As long as the asset is purchased and installed prior to 30 June 2020, the $150,000 applies…..except conditions do apply.

Let’s say you qualify as a small business (turnover less than $500 million), are gst registered and you purchase an asset for your business eg truck, for $150,000 + gst prior to 30 June 2020. You will be eligible to claim $150,000 in full as a tax deduction in the 2020 financial year. This is potentially a tax saving of around $50,000.

The downside to the above is there will be no tax savings in following years for depreciation.

However, we did mention there were conditions. The biggest one being that it doesn’t apply to cars designed to carry people.

If you purchase a car for your business, the instant asset write-off is limited to the business portion of the car limit of $57,581 for the 2019–20 income tax year. You cannot claim the excess cost of the car under any other depreciation rules.

As an example, let’s introduce Edward and Edna.

Edward and Edna own and run a small irrigation supplies business. On 27 March 2020 the business purchases a luxury car that is designed to carry passengers, for $80,000. The instant asset write-off threshold at the time they first use the car in the business is $150,000.

The cost of the car for depreciation is limited to the car limit at that time. As the cost of the car is above the $57,581 car cost limit for depreciation, the business can only claim an instant asset write-off of $57,581 for the year ending 30 June 2020.

They also decide to update their work ute and the business purchases a ute for $65,000 on 27 April 2020. The ute isn’t designed to carry passengers (and has been set up with all the trade tools in the tray) so the car cost limit for depreciation doesn’t apply. The business can claim a full deduction of $65,000 as an instant asset write-off.

Other assets that are excluded from this new limit are any capital works. This includes buildings and structural improvements.

Understanding the new limits can be a minefield, so please don’t hesitate to ask us for assistance.

Author

Kim Jay